21 Inference for correlation and slope

We now bring together ideas of inferential analyses with the descriptive models seen in Chapter 6. The setting is now focused on predicting a quantitative response variable, \(y\), from a quantitative explanatory variable, \(x\). We continue to ask questions about the variability of the model from sample to sample. The sampling variability will inform the conclusions about the population that can be drawn.

Many of the inferential ideas are remarkably similar to those covered in previous chapters. The technical conditions for simple linear regression are typically assessed graphically, although independence of observations continues to be of utmost importance.

In this chapter, we bring together the inferential methods used to make claims about a population from information in a sample and the modeling ideas seen in Chapter 6. In particular, we will conduct inference on the slope of a least squares regression line or the correlation to test whether or not there is a relationship between two quantitative variables. Additionally, we will build confidence intervals which quantify the slope of the linear regression line and correlation between two quantitative variables.

Below we summarize the notation used throughout this chapter.

Notation for two quantitative variables.

- \((x, y)\) = two measurements taken on a single observational unit

- \(n\) = sample size (number of \((x, y)\) pairs)

- \(r\) = sample correlation between two quantitative variables \(x\) and \(y\)

-

\(\hat{y} = b_0 + b_1 x\) = least-squares regression line

- \(\hat{y}\) = estimated or predicted response for a given value of \(x\)

- \(b_0\) = sample intercept (\(y\)-intercept) of the least-squares regression line

- \(b_1\) = sample slope of the least-squares regression line

- \(\rho\) = population correlation between two quantitative variables \(x\) and \(y\)

-

\(y = \beta_0 + \beta_1 x + \epsilon\) = population regression model

- \(y\) = observed value of the response for a given value of \(x\)

- \(\beta_0\) = intercept (\(y\)-intercept) of the population regression line

- \(\beta_1\) = slope of the population regression line

- \(\epsilon\) = random error (the difference between the observed reponse and the population mean response for a given value of \(x\))

21.1 Case study: Sandwich store

21.1.1 Observed data

We start the chapter with a hypothetical example describing the linear relationship between dollars spent advertising for a chain sandwich restaurant and monthly revenue. The hypothetical example serves the purpose of illustrating how a linear model varies from sample to sample. Because we have made up the example and the data (and the entire population), we can take many many samples from the population to visualize the variability. Note that in real life, we always have exactly one sample (that is, one dataset), and through the inference process, we imagine what might have happened had we taken a different sample. The change from sample to sample leads to an understanding of how the single observed dataset is different from the population of values, which is typically the fundamental goal of inference.

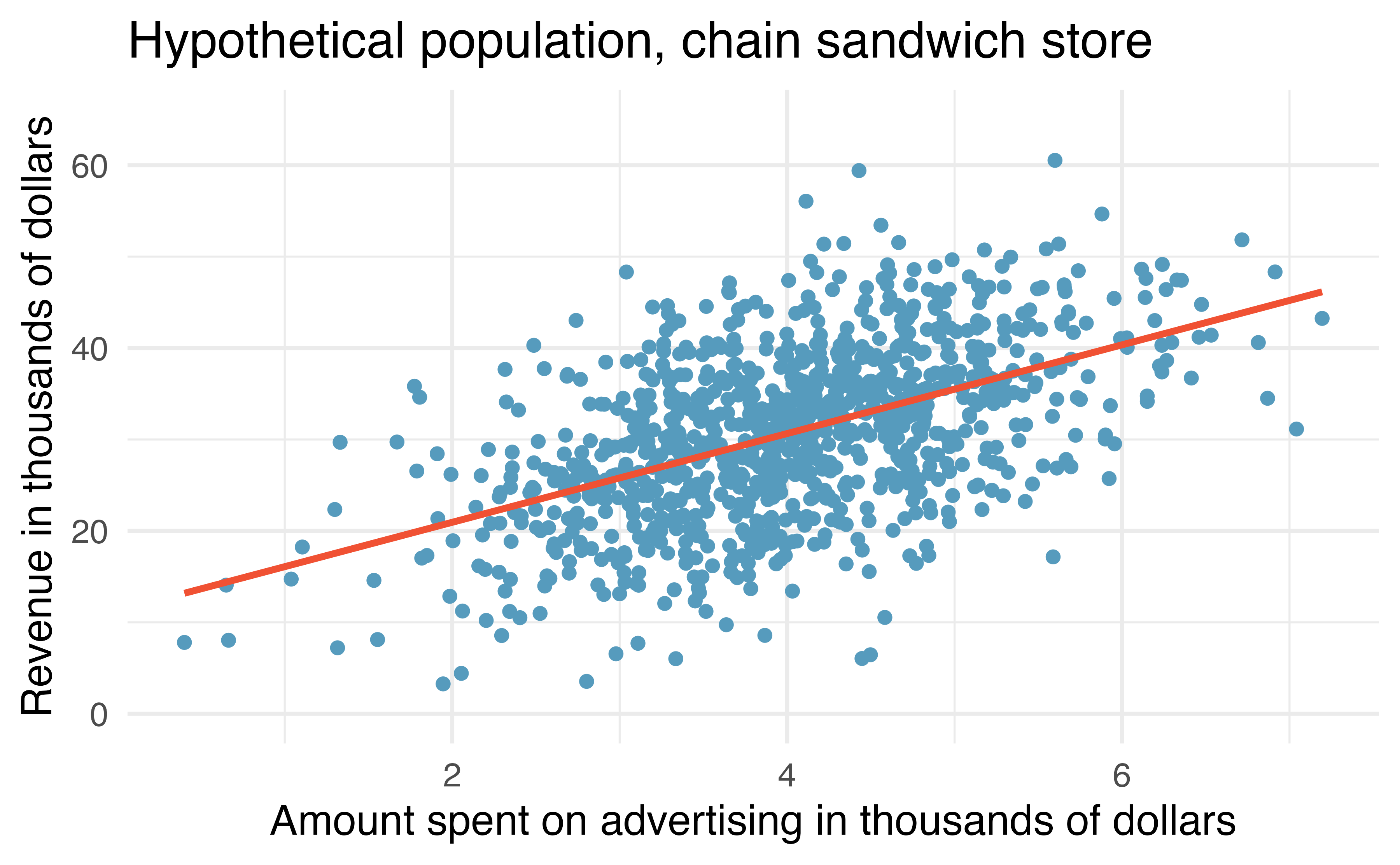

Consider the following hypothetical population of all of the sandwich stores of a particular chain seen in Figure 21.1. In this made-up world, the CEO actually has all the relevant data, which is why they can plot it here. The CEO is omniscient and can write down the population model which describes the true population relationship between the advertising dollars and revenue. There appears to be linear relationship between advertising dollars and revenue (both in $1000).

Figure 21.1: Revenue as a linear model of advertising dollars for a population of sandwich stores, in $1000.

You may remember from Chapter 6 that the population model is: \[y = \beta_0 + \beta_1 x + \varepsilon.\]

Again, the omniscient CEO (with the full population information) can write down the true population model as: \[\mbox{expected revenue} = 11.23 + 4.8 \cdot \mbox{advertising}.\]

21.1.2 Variability of the statistic

Unfortunately, in our scenario, the CEO is not willing to part with the full set of data, but they will allow potential franchise buyers to see a small sample of the data in order to help the potential buyer decide whether or not set up a new franchise. The CEO is willing to give each potential franchise buyer a random sample of data from 20 stores.

As with any numerical characteristic which describes a subset of the population, the estimated slope of a sample will vary from sample to sample. Consider the linear model which describes revenue (in $1000) based on advertising dollars (in $1000).

The least squares regression model uses the data to find a sample linear fit: \[\hat{y} = b_0 + b_1 x,\]

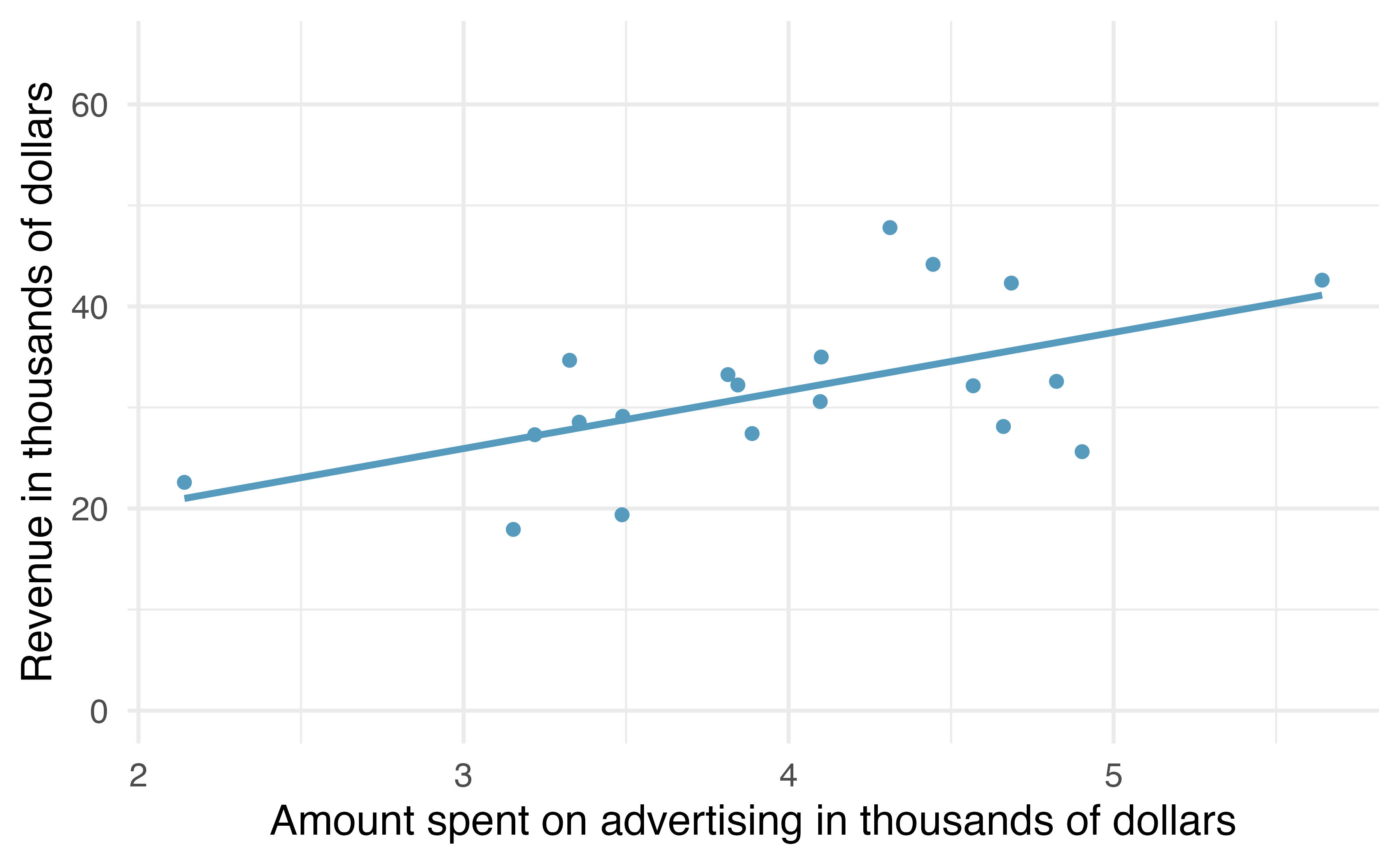

where \(y\) represents the actual revenue, \(\hat{y}\) represents the predicted revenue from the model, and \(x\) represents the advertising dollars. A random sample of 20 stores shows a different least square regression line depending on which observations are selected. A subset of size 20 stores shows a similar positive trend between advertising and revenue (to what we saw in Figure 21.1, which described the population) despite having fewer observations on the plot.

Figure 21.2: A random sample of 20 stores from the entire population. A positive linear trend between advertising and revenue continues to be observed.

A second sample of size 20 also shows a positive trend!

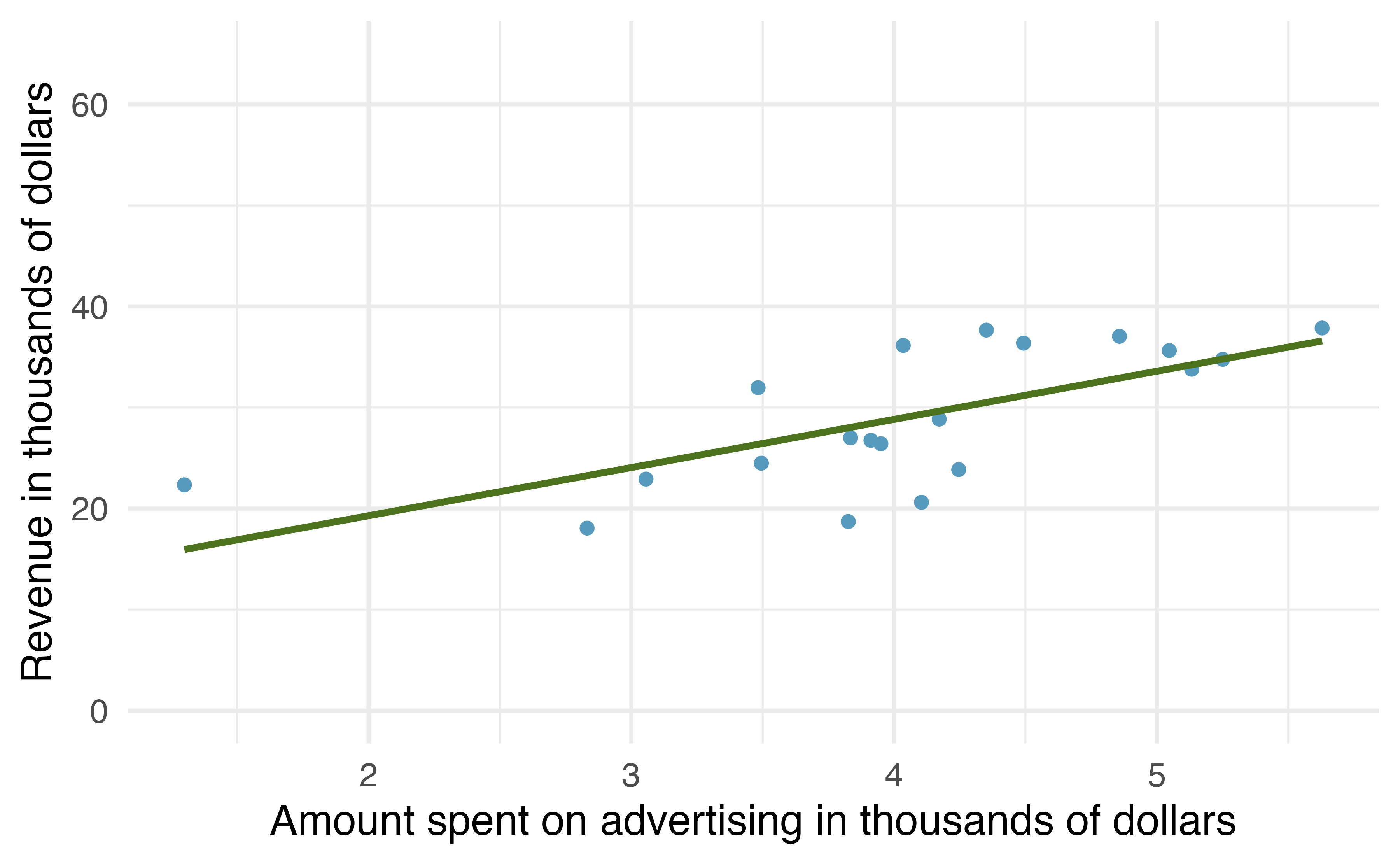

Figure 21.3: A different random sample of 20 stores from the entire population. Again, a positive linear trend between advertising and revenue is observed.

But the line is slightly different!

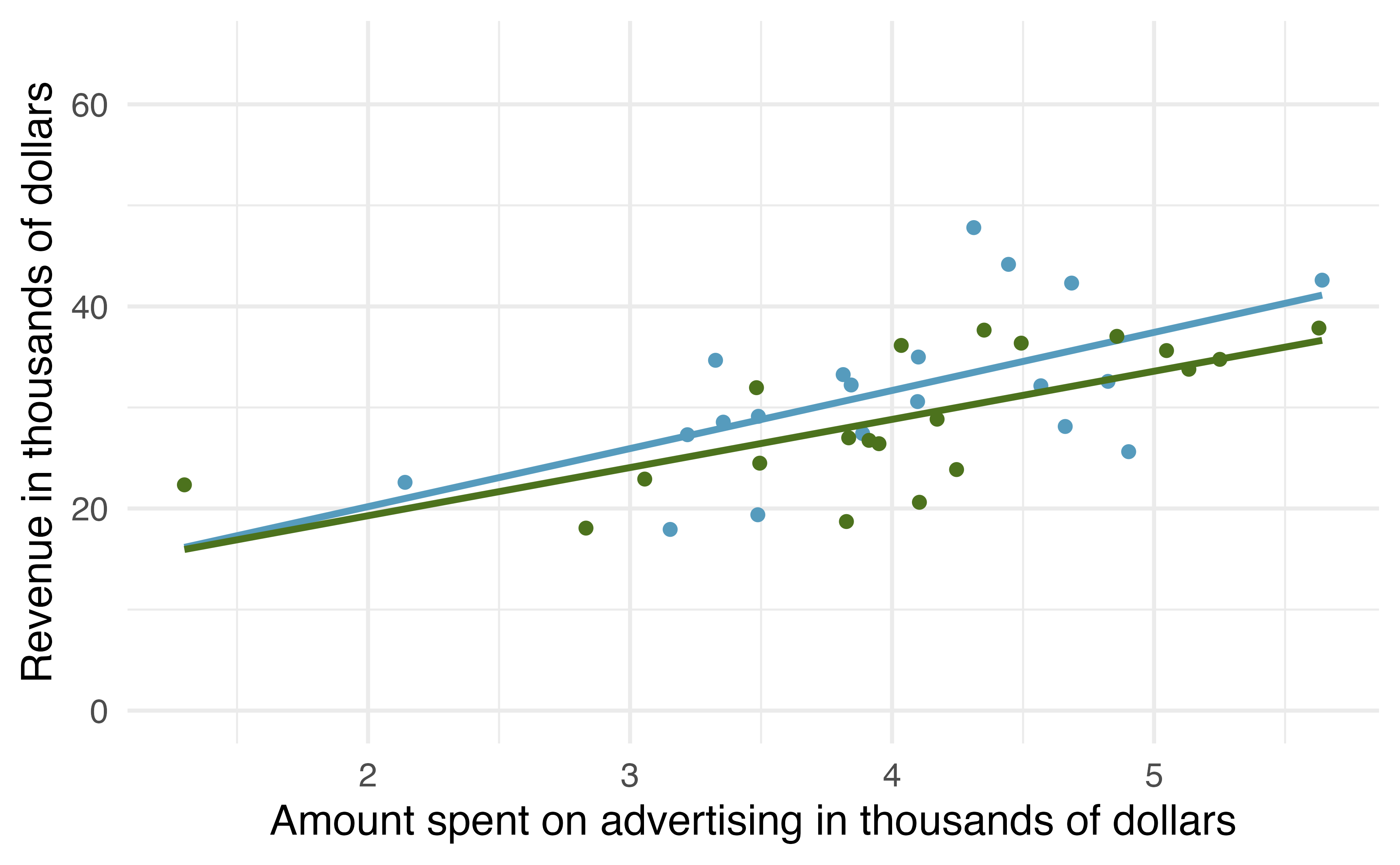

Figure 21.4: The linear models from the two different random samples are quite similar, but they are not the same line.

That is, there is variability in the regression line from sample to sample. The concept of the sampling variability is something you’ve seen before, but in this lesson, you will focus on the variability of the line often measured through the variability of a single statistic: the slope of the line.

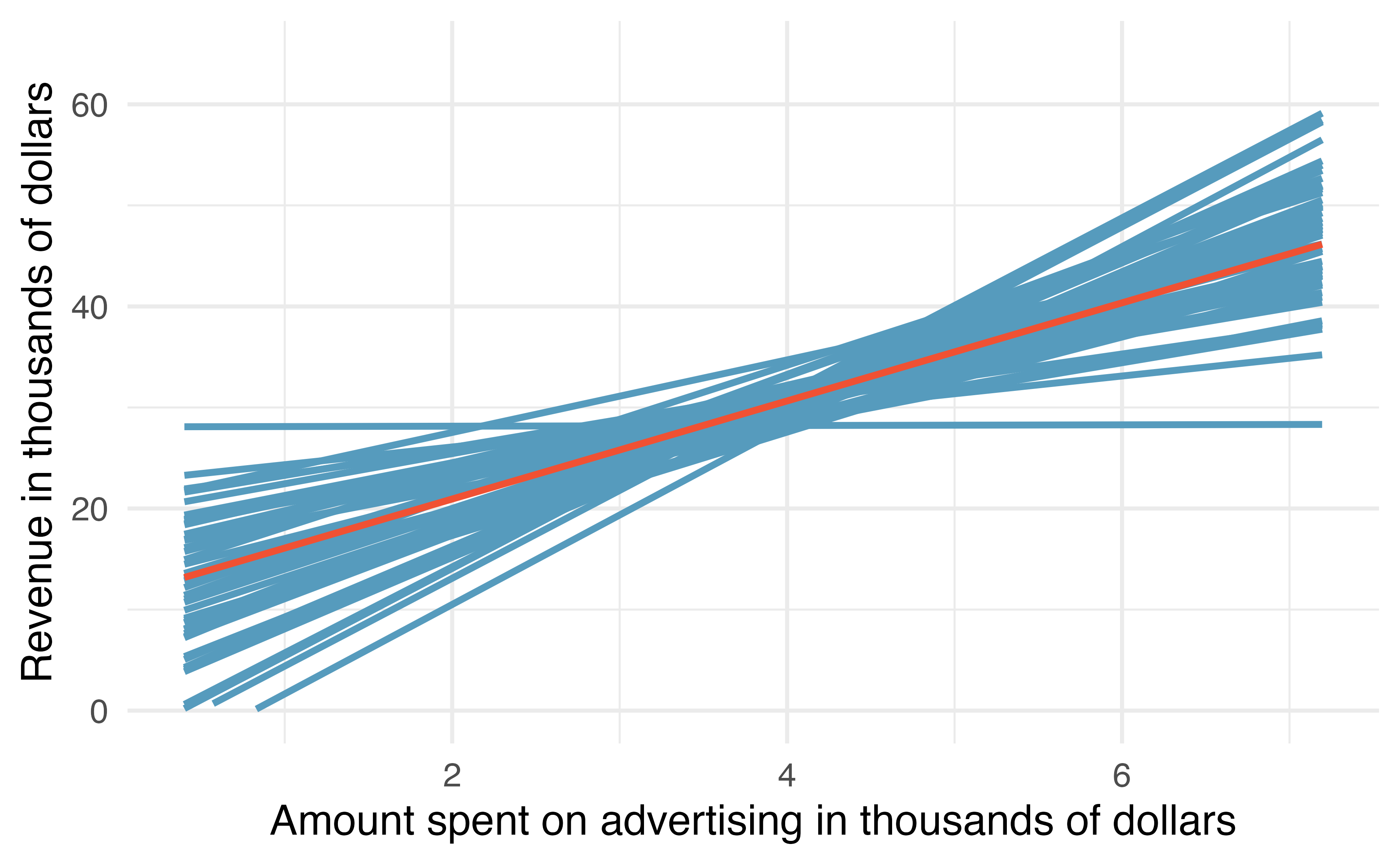

Figure 21.5: If repeated samples of size 20 are taken from the entire population, each linear model will be slightly different. The red line provides the linear fit to the entire population, shown in Figure 21.1.

You might notice in Figure 21.5 that the \(\hat{y}\) values given by the lines are much more consistent in the middle of the dataset than at the ends. The reason is that the data itself anchors the lines in such a way that the line must pass through the center of the data cloud. The effect of the fan-shaped lines is that predicted revenue for advertising close to $4,000 will be much more precise than the revenue predictions made for $1,000 or $7,000 of advertising.

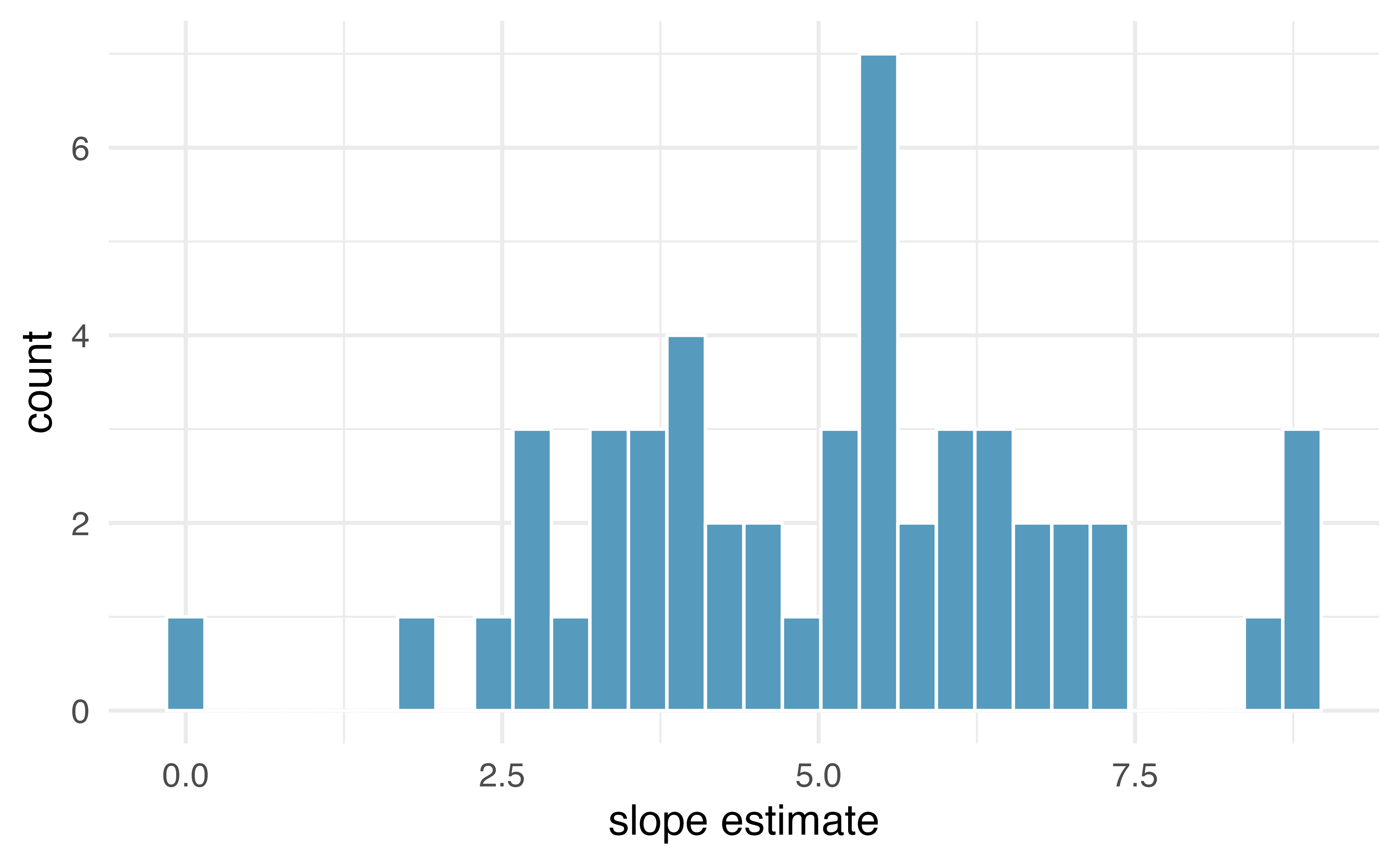

The distribution of slopes (for samples of size \(n=20\)) can be seen in a histogram, as in Figure 21.6.

Figure 21.6: Variability of slope estimates taken from many different samples of stores, each of size 20.

Recall, the example described in this introduction is hypothetical.

That is, we created an entire population in order demonstrate how the slope of a line would vary from sample to sample.

The tools in this textbook are designed to evaluate only one single sample of data.

With actual studies, we do not have repeated samples, so we are not able to use repeated samples to visualize the variability in slopes.

We have seen variability in samples throughout this text, so it should not come as a surprise that different samples will produce different linear models.

However, it is nice to visually consider the linear models produced by different slopes.

Additionally, as with measuring the variability of previous statistics (e.g., \(\bar{x}_1 - \bar{x}_2\) or \(\hat{p}_1 - \hat{p}_2\)), the histogram of the sample statistics can provide information related to inferential considerations.

In the following sections, the distribution (i.e., histogram) of \(b_1\) (the estimated slope coefficient) will be constructed in the same three ways that, by now, may be familiar to you. First (in Section 21.2), the distribution of \(b_1\) when \(\beta_1 = 0\) is constructed by randomizing (permuting) the response variable. Next (in Section 21.3), we can bootstrap the data by taking random samples of size \(n\) from the original dataset. And last (in Section 21.5), we use mathematical tools to describe the variability using the \(t\)-distribution that was first encountered in Section 17.3.

21.2 Randomization test for \(H_0: \beta_1= 0\)

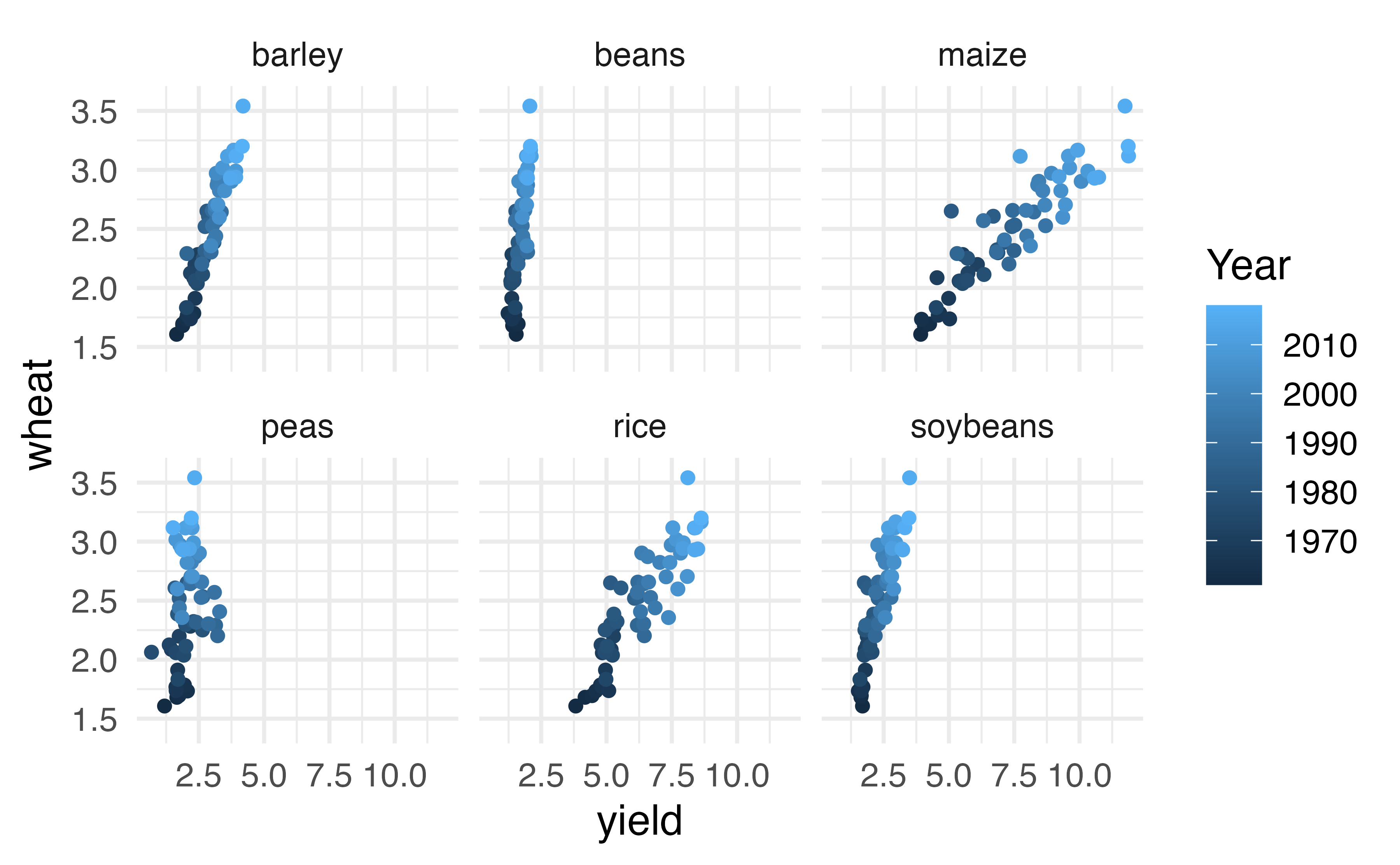

Consider the data on Global Crop Yields compiled by Our World in Data and presented as part of the TidyTuesday series seen in Figure 21.7. The scientific research interest at hand will be in determining the linear relationship between wheat yield (for a country-year) and other crop yields. The dataset is quite rich and deserves exploring, but for this example, we will focus only on the annual crop yield in the United States.

Figure 21.7: Yield (in tonnes per hectare) for six different crops in the US. The color of the dot indicates the year.

As you have seen previously, statistical inference typically relies on setting a null hypothesis which is hoped to be subsequently rejected. In the linear model setting, we might hope to have a linear relationship between maize and wheat in settings where maize production is known and wheat production needs to be predicted.

The relevant hypotheses for the linear model setting can be written in terms of the population slope parameter. Here the population refers to a larger set of years where maize and wheat are both grown in the US.

-

\(H_0: \beta_1= 0\), there is no linear relationship between

wheatandmaize.

-

\(H_A: \beta_1 \ne 0\), there is some linear relationship between

wheatandmaize.

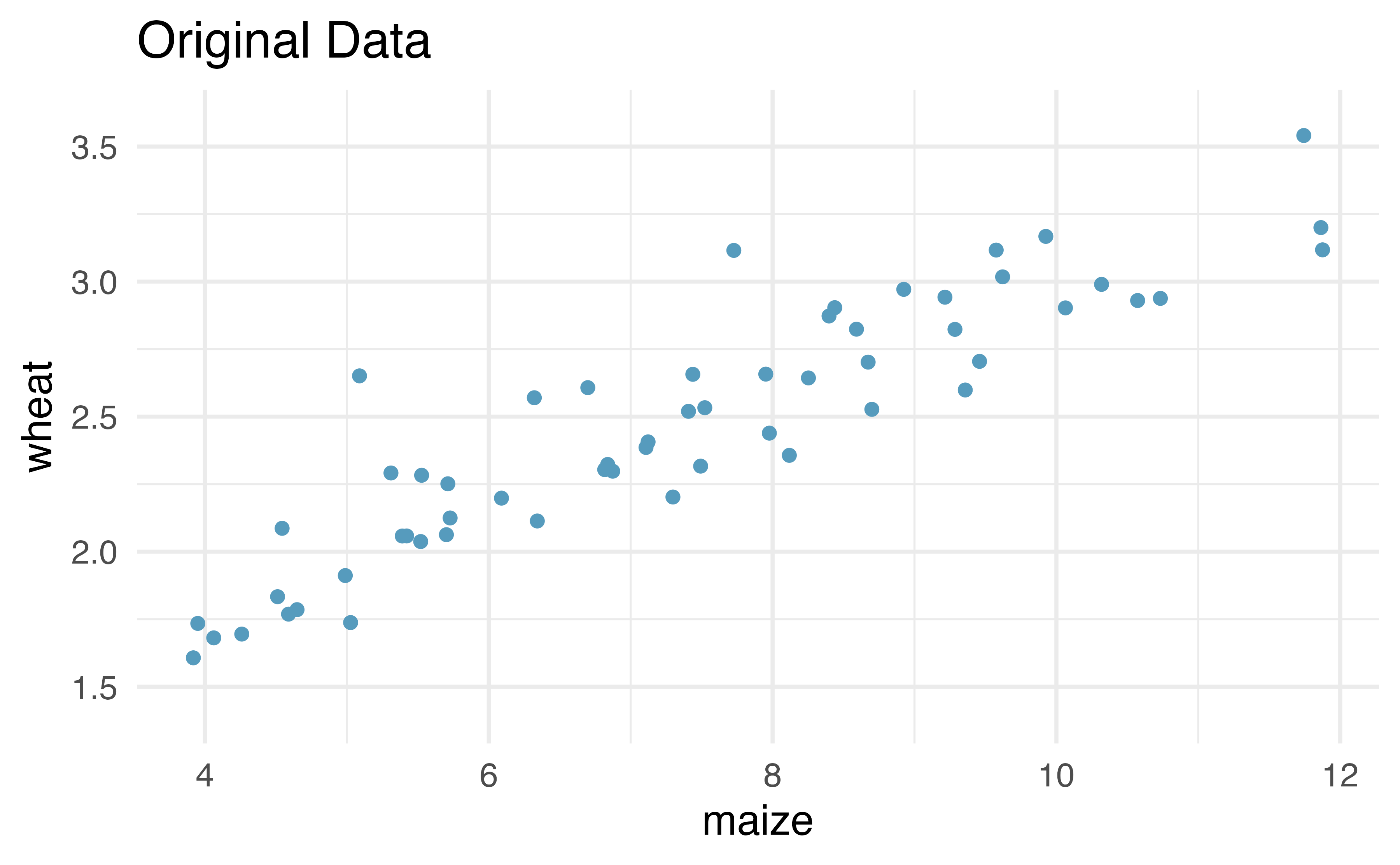

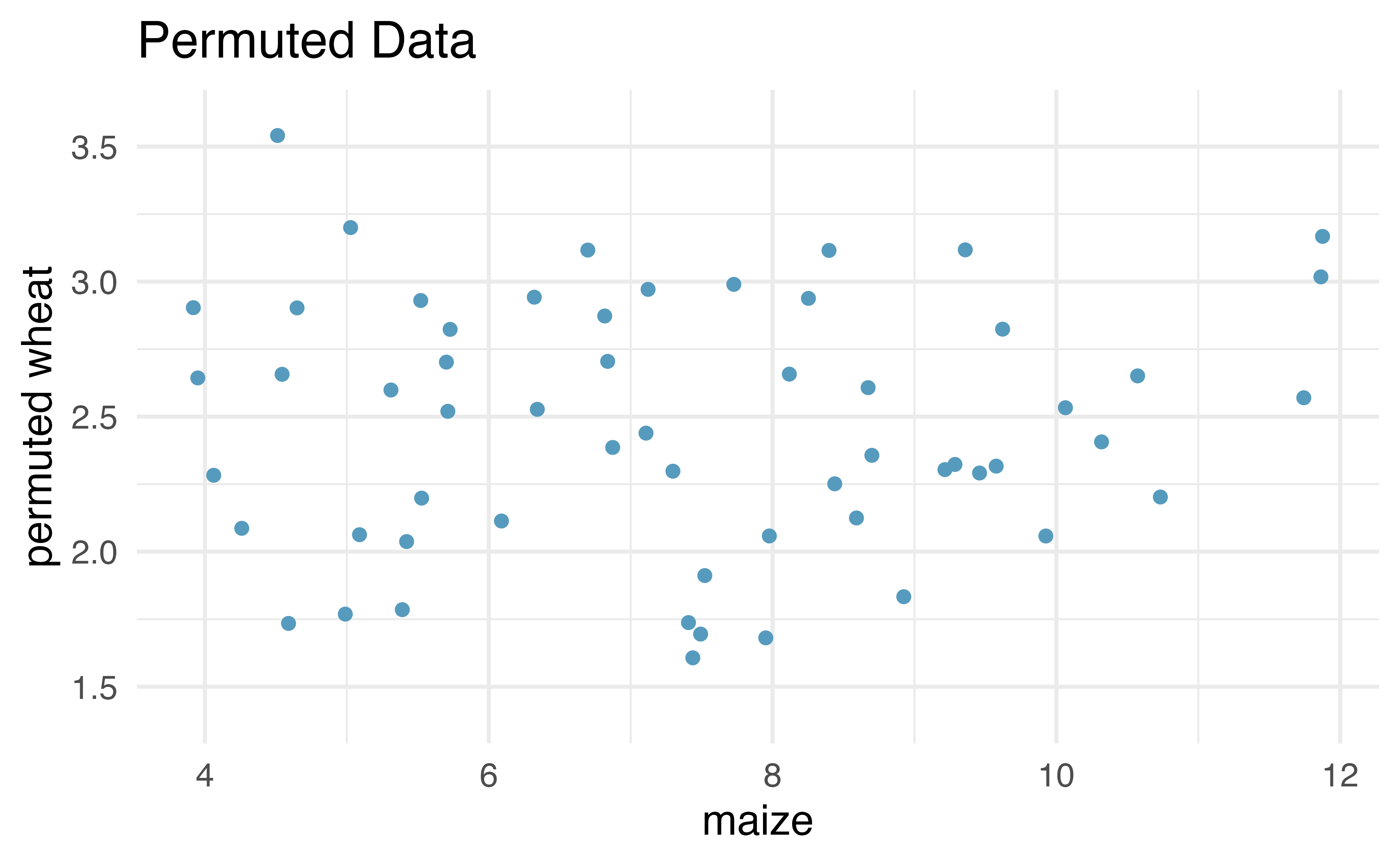

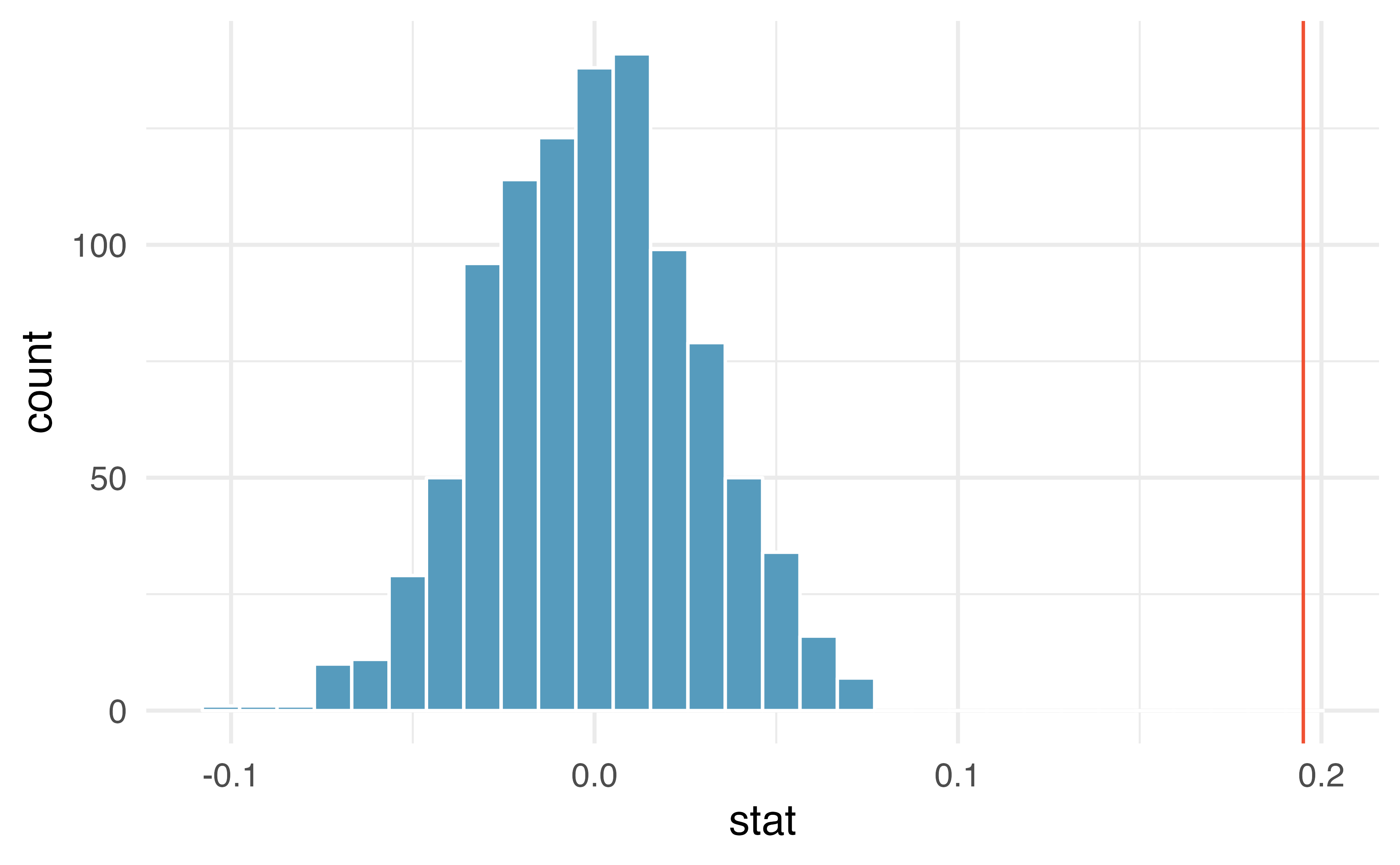

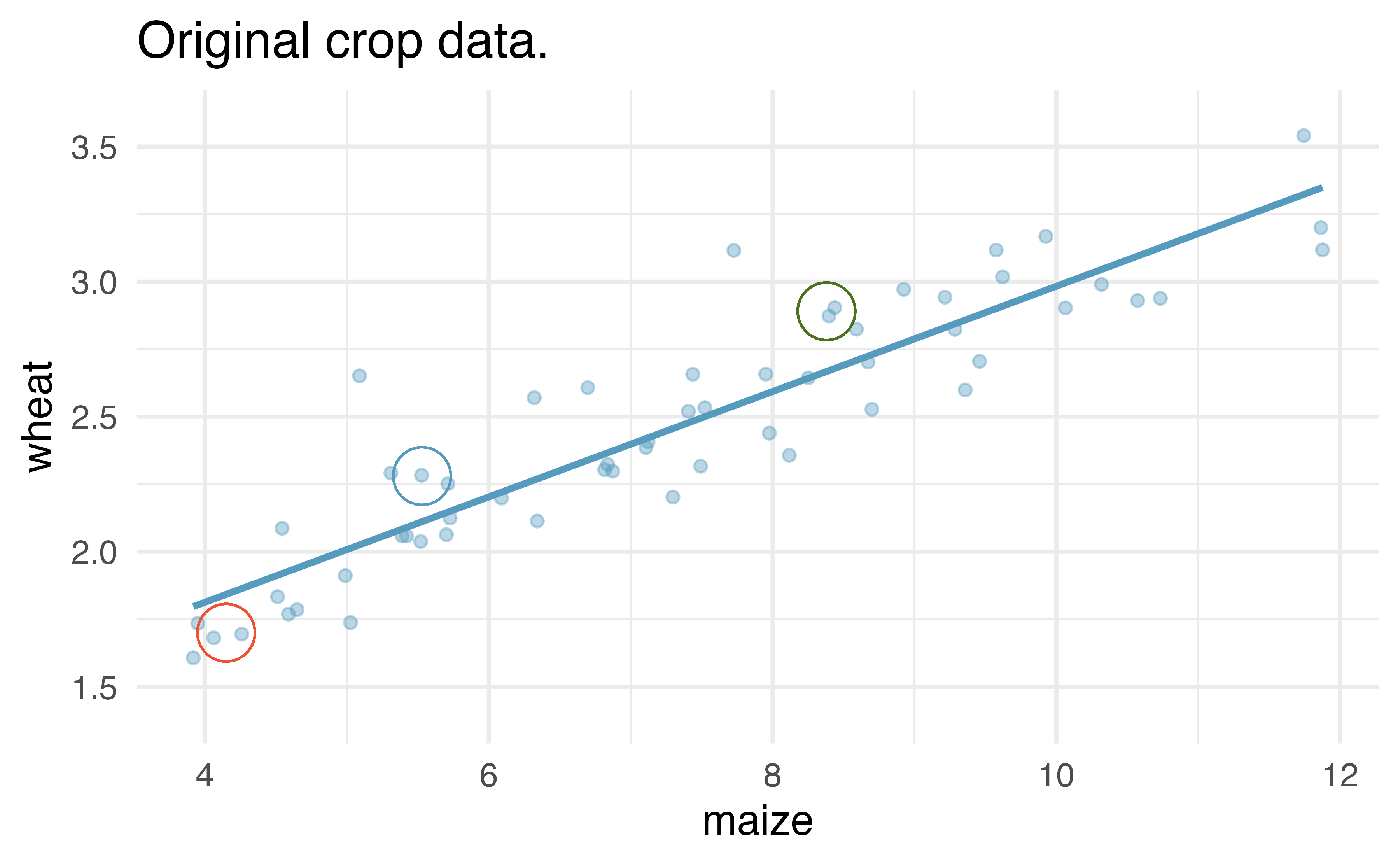

Recall that for the randomization test, we shuffle one variable to eliminate any existing relationship between the variables. That is, we set the null hypothesis to be true, and we measure the natural variability in the data due to sampling but not due to variables being correlated. Figure 21.8 shows the observed data and a scatterplot of one permutation of the wheat variable. The careful observer can see that each of the observed the values for wheat (and for maize) exist in both the original data plot as well as the permuted wheat plot, but the given wheat and maize yields are no longer matched for a given year. That is, each wheat yield is randomly assigned to a new maize yield.

Figure 21.8: Original (left) and permuted (right) data. The permutation removes the linear relationship between wheat and maize. Repeated permutations allow for quantifying the variability in the slope under the condition that there is no linear relationship (i.e., that the null hypothesis is true).

By repeatedly permuting the response variable, any pattern in the linear model that is observed is due only to random chance (and not an underlying relationship). The randomization test compares the slopes calculated from the permuted response variable with the observed slope. If the observed slope is inconsistent with the slopes from permuting, we can conclude that there is some underlying relationship (and that the slope is not merely due to random chance).

21.2.1 Observed data

We will continue to use the crop data to investigate the linear relationship between wheat and maize. Note that the fitted least squares model (see Chapter 6) describing the relationship is given in Table 21.1.

| term | estimate | std.error | statistic | p.value |

|---|---|---|---|---|

| (Intercept) | 1.033 | 0.091 | 11.3 | 0 |

| maize | 0.195 | 0.012 | 16.4 | 0 |

From the “estimate” column, we can write our least squares regression line as \[ \hat{y} = 1.033 + 0.195x, \] where \(\hat{y}\) is the predicted wheat yield, and \(x\) is the maize yield (both in tonnes per hectare).

The other columns in Table 21.1 are further described in Section 21.5 when we introduce theory-based methods for inference on a regression slope.

21.2.2 Variability of the statistic

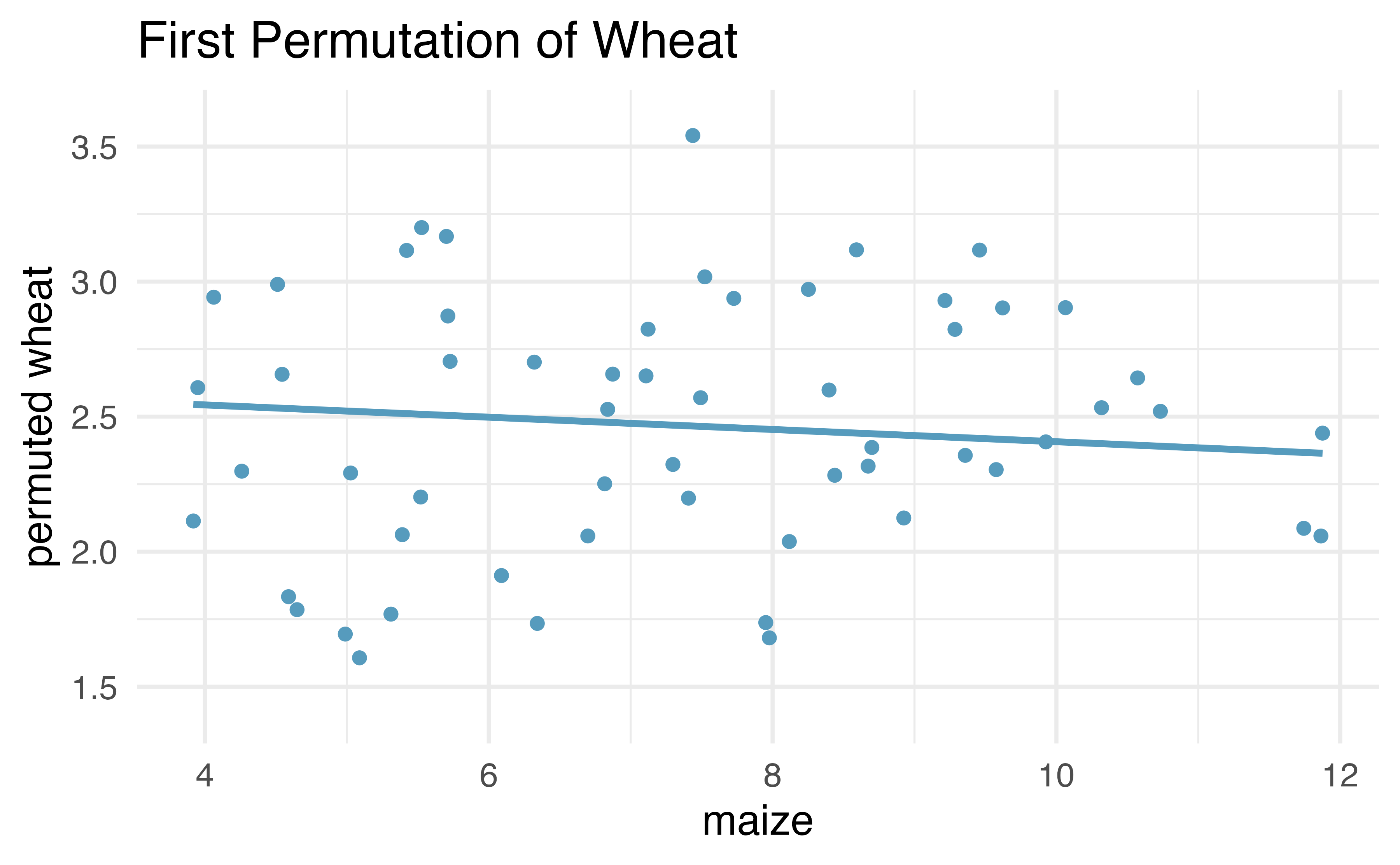

After permuting the data, the least squares estimate of the line can be computed. Repeated permutations and slope calculations describe the variability in the line (i.e., in the slope) due only to the natural variability and not due to a relationship between wheat and maize. Figure 21.9 shows two different permutations of wheat and the resulting linear models.

Figure 21.9: Two different permutations of the wheat variable with slightly different least squares regression lines.

As you can see, sometimes the slope of the permuted data is positive, sometimes it is negative. Because the randomization happens under the condition of no underlying relationship (because the response variable is completely mixed with the explanatory variable), we expect to see the center of the randomized slope distribution to be zero.

21.2.3 Observed statistic vs. null value

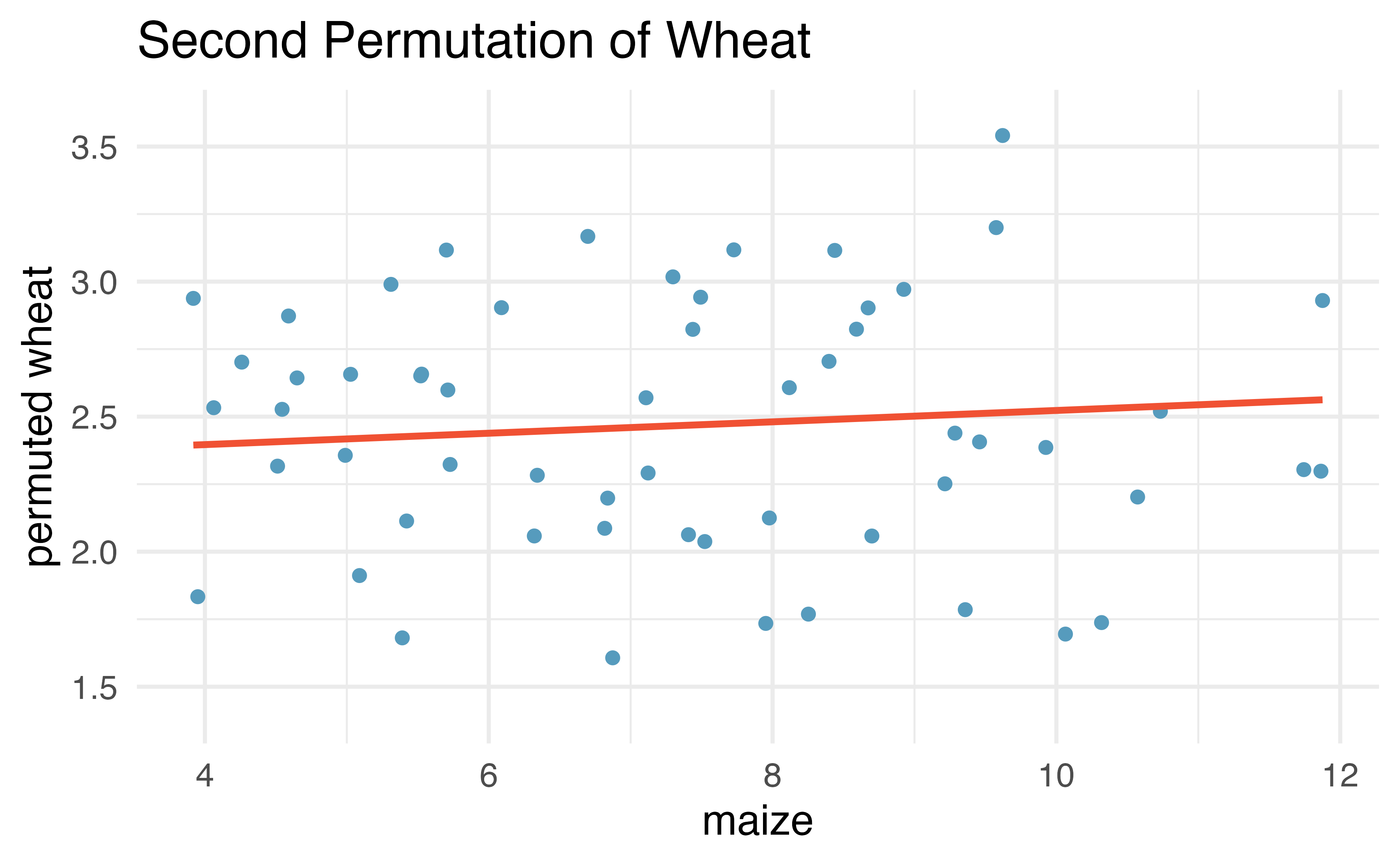

Figure 21.10: Histogram of slopes given different permutations of the wheat variable. The vertical red line is at the observed value of the slope, \(b_1\) = 0.195.

As we can see from Figure 21.10, a slope estimate as extreme as the observed slope estimate (the red line) never happened in many repeated permutations of the wheat variable.

That is, if indeed there were no linear relationship between wheat and maize, the natural variability of the slopes would produce estimates between approximately -0.1 and +0.1.

Therefore, we believe that the slope observed on the original data is not just due to natural variability and indeed, there is a linear relationship between wheat and maize crop yield (in tonnes per hectare) in the US.

21.3 Bootstrap confidence interval for \(\beta_1\)

As we have seen in previous chapters, we can use bootstrapping to estimate the sampling distribution of the statistic of interest (here, the slope) without the null assumption of no relationship (which was the condition in the randomization test). Because interest is now in creating a CI, there is no null hypothesis, so there won’t be any reason to permute either of the variables.

21.3.1 Observed data

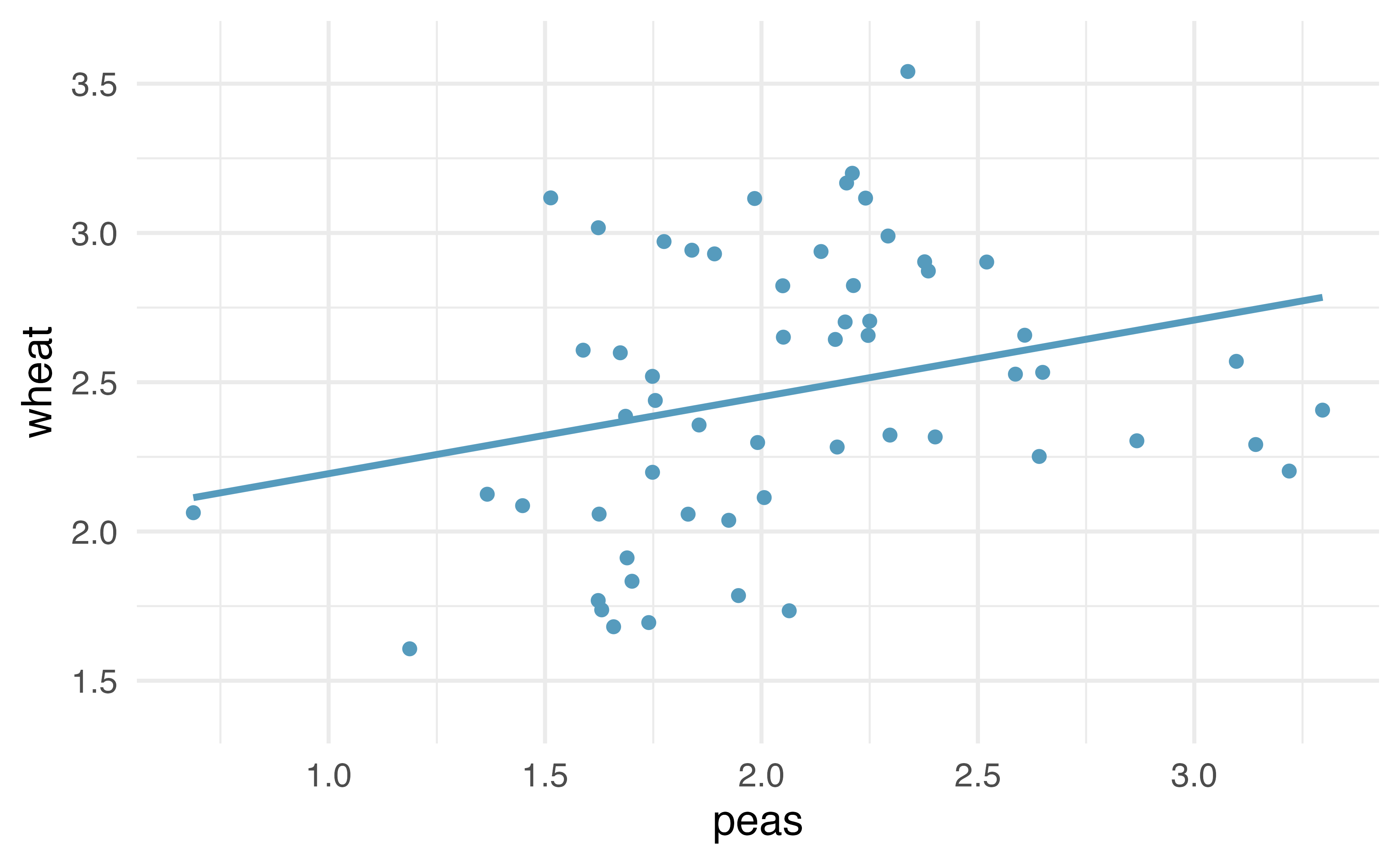

Returning to the crop data, we may want to consider the relationship between yields in peas and wheat. Are peas a good predictor of wheat? And if so, what is their relationship? That is, what is the slope that models the average wheat yield as a function of peas yield (both in tonnes per hectare)?

Figure 21.11: Original data: wheat yield as a linear model of peas yield, in tonnes per hectare. Notice that the relationship between peas and wheat is not as strong as the relationship we saw previously between maize and wheat.

21.3.2 Variability of the statistic

Because we are not focused on a null distribution, we sample with replacement \(n=58\) \((x,y)\)-pairs from the original dataset. Recall that with bootstrapping, we always resample the same number of observations as we start with in order to mimic the process of taking a sample from the population. When sampling in the linear model case, consider each observation to be a single dot on the scatterplot. If the dot is resampled, both the wheat and the peas measurement are observed. The measurements are linked to the dot (i.e., to the year in which the measurements were taken).

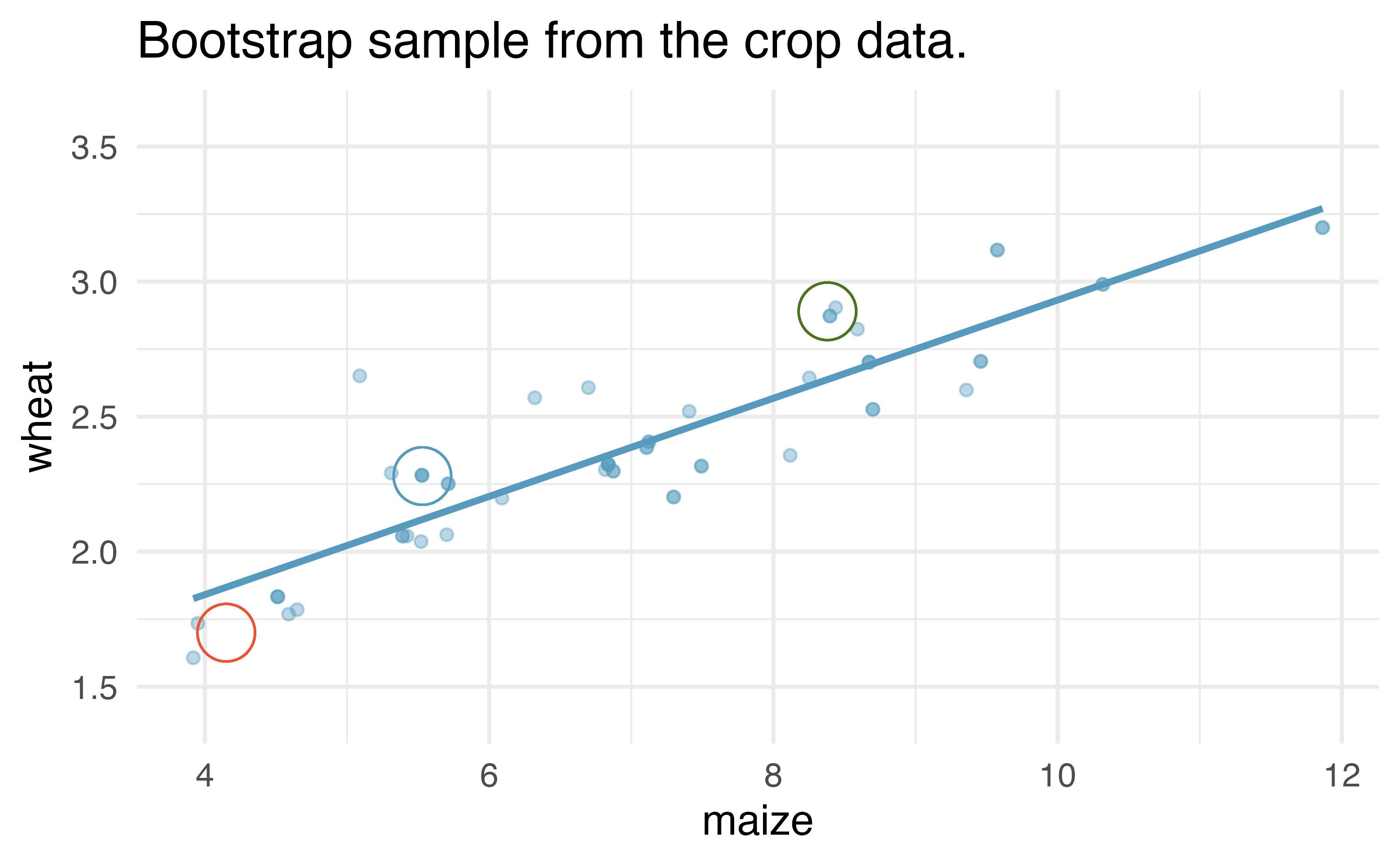

Figure 21.12: Original and one bootstrap sample of the crop data. Note that it is difficult to differentiate the two plots, as (within a single bootstrap sample) the observations which have been resampled twice are plotted as points on top of one another. The orange circle represent points in the original data which were not included in the bootstrap sample. The blue circle represents a point that was repeatedly resampled (and is therefore darker) in the bootstrap sample. The green circle represents a particular structure to the data which is observed in both the original and bootstrap samples.

Figure 21.12 shows the original data as compared with a single bootstrap sample, resulting in (slightly) different linear models. The orange circle represent points in the original data which were not included in the bootstrap sample. The blue circle represents a point that was repeatedly resampled (and is therefore darker) in the bootstrap sample. The green circle represents a particular structure to the data which is observed in both the original and bootstrap samples. By repeatedly resampling, we can see dozens of bootstrapped slopes on the same plot in Figure 21.13.

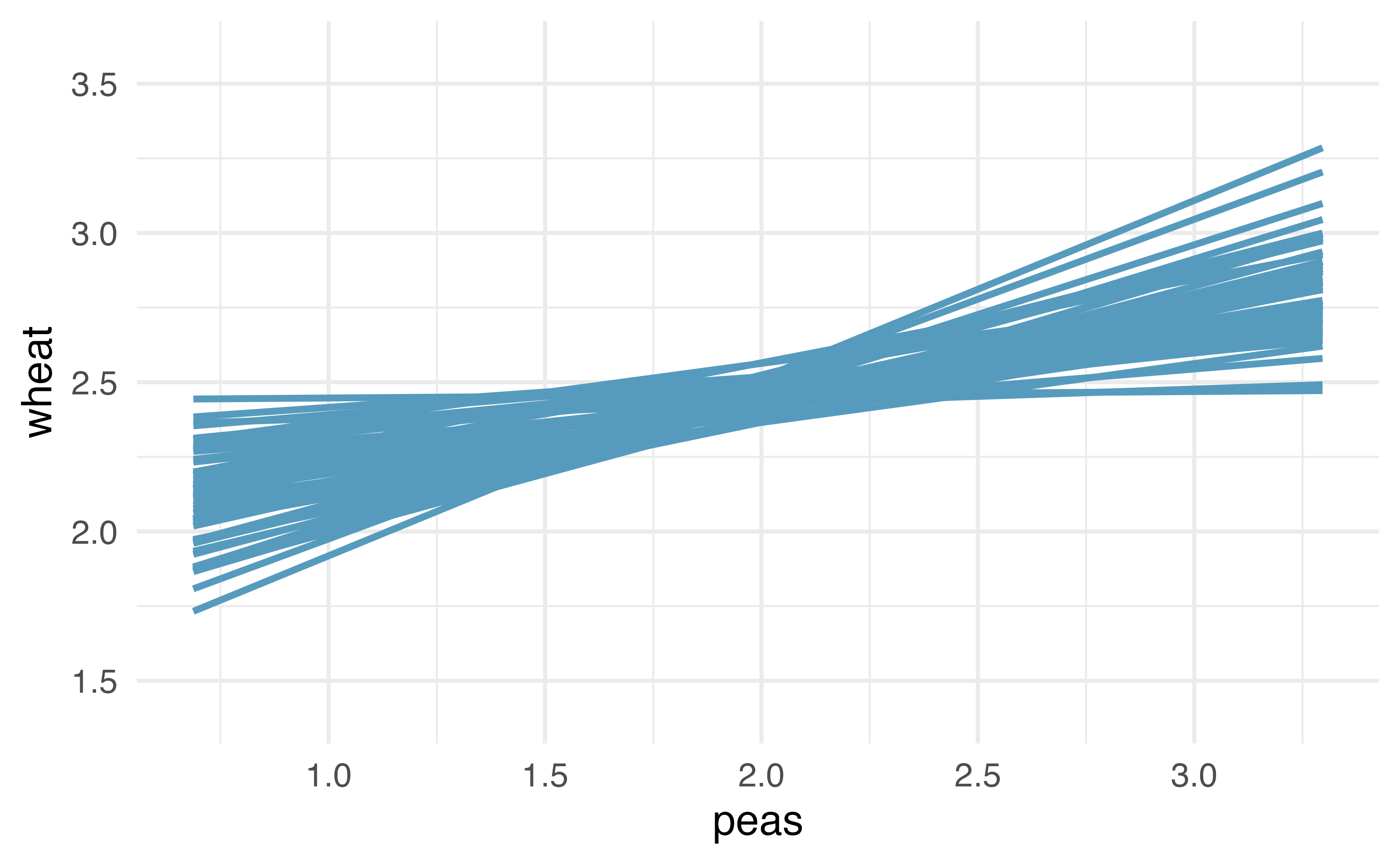

Figure 21.13: Repeated bootstrap resamples of size 58 are taken from the original data. Each of the bootstrapped linear model is slightly different.

Recall that in order to create a confidence interval for the slope, we need to find the range of values that the statistic (here the slope) takes on from different bootstrap samples.

Figure 21.14 is a histogram of the relevant bootstrapped slopes.

We can see that a 95% bootstrap percentile interval for the true population slope is given by (0.061, 0.52).

We are 95% confident that for the model describing the population of crops of peas and wheat, a one ton per hectare increase in peas yield will be associated with an increase in predicted average wheat yield of between 0.061 and 0.52 tonnes per hectare.

Figure 21.14: The original crop data on wheat and peas is bootstrapped 1,000 times. The histogram provides a sense for the variability of the standard deviation of the linear model slope from sample to sample.

21.4 Inference on the correlation coefficient \(\rho\)

Both the randomization test and the bootstrap confidence interval methods can be used to simulate any sample summary measure, not just the sample slope, \(b_1\). For example, we could write the hypotheses from the example in Section 21.2 in terms of the population correlation coefficient, \(\rho\):

-

\(H_0: \rho= 0\), the true correlation between

wheatandmaizeis equal to zero.

-

\(H_A: \rho \ne 0\), the true correlation between

wheatandmaizeis not equal to zero.

All simulation methods then proceed in the same way, but using the sample correlation, \(r\), as our statistic to simulate rather than the sample slope.

21.5 Theory-based inferential methods for \(\beta_1\)

When certain technical conditions apply, it is convenient to use mathematical approximations to test and estimate the slope parameter. The approximations will build on the \(t\)-distribution which was first encountered in Chapter 17. This mathematical model is often correct and is usually easy to implement computationally. The validity of the technical conditions will be considered in detail in Section 21.6.

In this section, we discuss uncertainty in the estimates of the slope and \(y\)-intercept for a regression line. Just as we identified standard errors for point estimates in previous chapters, we first discuss standard errors for these new estimates.

21.5.1 Case study: Midterm elections and unemployment

Elections for members of the United States House of Representatives occur every two years, coinciding every four years with the U.S. Presidential election. The set of House elections occurring during the middle of a Presidential term are called midterm elections. In America’s two-party system (the vast majority of House members through history have been either Republicans or Democrats), one political theory suggests the higher the unemployment rate, the worse the President’s party will do in the midterm elections. In 2020, there were 232 Democrats, 198 Republicans, and 1 Libertarian in the House.

To assess the validity of this claim, we can compile historical data and look for a connection. We consider every midterm election from 1898 to 2018, with the exception of those elections during the Great Depression. The House of Representatives is made up of 435 voting members. Figure 21.15 shows these data and the least-squares regression line: \[\begin{aligned} &\text{predicted % change in House seats for President's party} \\ &\qquad\qquad= -7.36 - 0.89 \times \text{(unemployment rate)}\end{aligned}\] We consider the percent change in the number of seats of the President’s party (e.g., percent change in the number of seats for Republicans in 2018) against the unemployment rate.

What are the observational units in this data set?161

Examining the data, there are no clear deviations from linearity or substantial outliers (see Section 21.6 for a discussion on using residuals to visualize how well a linear model fits the data). While the data are collected sequentially, a separate analysis was used to check for any apparent correlation between successive observations in time; no such correlation was found.

Figure 21.15: The percent change in House seats for the President’s party in each midterm election from 1898 to 2010 plotted against the unemployment rate. The two points for the Great Depression have been removed, and a least squares regression line has been fit to the data.

The data for the Great Depression (1934 and 1938) were removed because the unemployment rate was 21% and 18%, respectively. Do you agree that they should be removed for this investigation? Why or why not?162

There is a negative slope in the line shown in Figure 21.15. However, this slope (and the y-intercept) are only estimates of the parameter values. We might wonder, is this convincing evidence that the “true” linear model has a negative slope? That is, do the data provide strong evidence that the political theory is accurate, where the unemployment rate is a useful predictor of the midterm election? We can frame this investigation into a statistical hypothesis test:

-

\(H_0\): \(\beta_1 = 0\). The true linear model has a zero slope.

- \(H_A\): \(\beta_1 < 0\). The true linear model has a negative slope. The percent change in House seats for the President’s party is negatively correlated with percent unemployment.

To assess the hypotheses, we identify a standard error for the estimate, compute an appropriate test statistic, and identify the p-value.

21.5.2 Understanding regression output from software

Just like other point estimates we have seen before, we can compute a standard error and test statistic for \(b_1\). We will generally label the test statistic using a \(T\), since it follows the \(t\)-distribution.

We will rely on statistical software to compute the standard error and

leave the explanation of how this standard error is determined to a

second or third statistics course.

Table 21.2 shows software output for the least

squares regression line in Figure 21.15. The row labeled unemp includes all relevant information about the slope estimate (i.e., the coefficient of the unemployment variable).

| term | estimate | std.error | statistic | p.value |

|---|---|---|---|---|

| (Intercept) | -7.36 | 5.155 | -1.43 | 0.165 |

| unemp | -0.89 | 0.835 | -1.07 | 0.296 |

What do the first and second columns of Table 21.2 represent?

The entries in the first column represent the least squares estimates, \(b_0\) and \(b_1\). Using the estimates, we could write the equation for the least square regression line as \[\begin{aligned} \hat{y} = -7.36 - 0.89 x \end{aligned}\] where \(\hat{y}\) in this case represents the predicted change in the number of seats for the president’s party, and \(x\) represents the unemployment rate.

The values in the second column correspond to the standard errors of each estimate, \(SE(b_0)\) and \(SE(b_1)\). We will use these values when computing a test statistic or confidence interval for \(\beta_0\) or \(\beta_1\).

We previously used a \(t\)-test statistic for hypothesis testing in the context of numerical data. Regression is very similar. In the hypotheses we consider, the null value for the slope is 0, so we can compute the test statistic using the T-score formula: \[\begin{aligned} T = \frac{\text{estimate} - \text{null value}}{\text{SE(estimate)}} = \frac{-0.89 - 0}{0.835} = -1.07\end{aligned}\] This corresponds to the third column of Table 21.2 .

Use Table 21.2 to determine the p-value for the hypothesis test.

The last column of the table gives the p-value for a two-sided hypothesis test for the coefficient of the unemployment rate: 0.296. However, our test is one-sided — we are only interested in detecting if the true slope coefficient is negative. Since our estimated slope coefficient is negative, our one-sided p-value is just half of the two-sided p-value: 0.148.163 With this p-value, the data do not provide convincing evidence that a higher unemployment rate has a negative correlation with percent of seats lost in the house. In other words, we do not have significant evidence for the political theory that the higher the unemployment rate, the worse the President’s party will do in the midterm elections.

21.5.3 Intuition vs. formal inference

As the final step in a mathematical hypothesis test for the slope, we use the information provided to make a conclusion about whether or not the data could have come from a population where the true slope was zero (i.e., \(\beta_1 = 0\)). Before evaluating the formal hypothesis claim, sometimes it is important to check your intuition. Based on everything we’ve seen in the examples above describing the variability of a line from sample to sample, as yourself if the linear relationship given by the data could have come from a population in which the slope was truly zero.

Elmhurst College in Illinois released anonymized data for family income and financial support provided by the school for Elmhurst’s first-year students in 2011. Figure 21.16 shows the least-squares regression line fit to a scatterplot of a sample of the data. How sure are you that the slope is statistically significantly different from zero? That is, do you think a formal hypothesis test would reject the claim that the true slope of the line should be zero?

While the relationship between the variables is not perfect, there is an evident decreasing trend in the data. This suggests the hypothesis test will reject the null claim that the slope is zero.

Figure 21.16: Gift aid and family income for a random sample of 50 first-year students from Elmhurst College, shown with a regression line.

The point of the tools in this section are to go beyond a visual interpretation of the linear relationship toward a formal mathematical claim about the statistical significance of the slope estimate.

| term | estimate | std.error | statistic | p.value |

|---|---|---|---|---|

| (Intercept) | 24319.329 | 1291.450 | 18.83 | 0 |

| family_income | -0.043 | 0.011 | -3.98 | 0 |

Table 21.3 shows statistical software output from fitting the least squares regression line shown in Figure 21.16. Use the output to formally evaluate the following hypotheses.

-

\(H_0\): The true coefficient for family income is zero.

- \(H_A\): The true coefficient for family income is not zero.164

Inference for regression.

We usually rely on statistical software to identify point estimates, standard errors, test statistics, and p-values in practice. However, be aware that software will not generally check whether the method is appropriate, meaning we must still verify conditions are met. See Section 21.6.

21.5.4 Theory-based confidence interval for a regression coefficient

Similar to how we can conduct a hypothesis test for a model coefficient using regression output, we can also construct a confidence interval for that coefficient.

Confidence intervals for coefficients

Confidence intervals for model coefficients (e.g., the \(y\)-intercept or the slope) can be computed using the \(t\)-distribution: \[\begin{aligned} b_i \ \pm\ t_{df}^{\star} \times SE(b_{i}) \end{aligned}\] where \(t_{df}^{\star}\) is the appropriate \(t\)-value corresponding to the confidence level with the model’s degrees of freedom. For simple linear regression, the model’s degrees of freedom are \(n-1\).

Compute a 95% confidence interval for the slope coefficient using the regression output from Table 21.3.

The point estimate is \(b_1 = -0.0431\) and the standard error is \(SE(b_1) = 0.0108\). The degrees of freedom for the distribution are \(df = n - 2 = 48\), and are typically noted in the regression output, allowing us to identify \(t_{48}^{\star} = 2.01\) for use in the confidence interval.

We can now construct the confidence interval in the usual way: \[\begin{aligned} \text{point estimate} &\pm t_{48}^{\star} \times SE(\text{point estimate}) \\ &\qquad\to\qquad \\ -0.0431 &\pm 2.01 \times 0.0108 \\ &\qquad\to\qquad\\ (-0.&0648, -0.0214) \end{aligned}\] We are 95% confident that, with each $1000 increase in family income, the university’s gift aid is predicted to decrease on average by between $21.40 to $64.80.

On the topic of intervals in this book, we’ve focused exclusively on confidence intervals for model parameters. However, there are other types of intervals that may be of interest, including prediction intervals for a response value and also confidence intervals for a mean response value in the context of regression. These intervals are typically covered in a second course in statistics.

21.6 Checking model conditions

In the previous sections, we used randomization and bootstrapping to perform inference when the mathematical model was not valid due to violations of the technical conditions. In this section, we’ll provide details for when the mathematical model is appropriate and a discussion of technical conditions needed for the randomization and bootstrapping procedures.

What are the technical conditions?

When fitting a least squares line, we generally require

Linearity. The data should show a linear trend. If there is a nonlinear trend (e.g., first panel of Figure 21.17, an advanced regression method from another book or later course should be applied.

Independent observations. Be cautious about applying regression to data, which are sequential observations in time such as a stock price each day. Such data may have an underlying structure that should be considered in a model and analysis. An example of a data set where successive observations are not independent is shown in the fourth panel of Figure 21.17. There are also other instances where correlations within the data are important, such as the paired data described in Section 18.

Nearly normal residuals. Generally, the residuals must be nearly normal. When this condition is found to be unreasonable, it is usually because of outliers or concerns about influential points, which were discussed in Section 6.3. An example of a residual that would be a potentially concern is shown in Figure 21.17, where one observation is clearly much further from the regression line than the others.

Constant or equal variability (variance). The variability of points around the least squares line remains roughly constant. An example of non-constant variability is shown in the third panel of Figure 21.17, which represents the most common pattern observed when this condition fails: the variability of \(y\) is larger when \(x\) is larger.

Figure 21.17: Four examples showing when the methods in this chapter are insufficient to apply to the data. The top set of graphs represents the \(x\) and \(y\) relationship. The bottom set of graphs is a residual plot. First panel: linearity fails. Second panel: there are outliers, most especially one point that is very far away from the line. Third panel: the variability of the errors is related to the value of \(x\). Fourth panel: a time series data set is shown, where successive observations are highly correlated.

Should we have concerns about applying least squares regression to the Elmhurst data in Figure 6.13?165

The technical conditions are often remembered using the LINE mnemonic. The linearity, normality, and equality of variance conditions usually can be assessed through residual plots, as seen in Figure 21.17. A careful consideration of the experimental design should be undertaken to confirm that the observed values are indeed independent.

- L: linear model

- I: independent observations

- N: points are normally distributed around the line

- E: equal variability around the line for all values of the explanatory variable

Why do we need technical conditions?

As with other inferential techniques we have covered in this text, if the technical conditions above don’t hold, then it is not possible to make concluding claims about the population. That is, without the technical conditions, the T-score (or Z-score) will not have the assumed t-distribution (or standard normal Z distribution). That said, it is almost always impossible to check the conditions precisely, so we look for large deviations from the conditions. If there are large deviations, we will be unable to trust the calculated p-value or the endpoints of the resulting confidence interval.

21.6.1 Linearity

The linearity condition is among the most important if your goal is to understand a linear model between \(x\) and \(y\). For example, the value of the slope will not be at all meaningful if the true relationship between \(x\) and \(y\) is quadratic. Not only should we be cautious about the inference, but the model itself is also not an accurate portrayal of the relationship between the variables. An extended discussion on the different methods for modeling functional forms other than linear is outside the scope of this text.

21.6.2 Independence

The technical condition describing the independence of the observations is often the most crucial but also the most difficult to diagnose. It is also extremely difficult to gather a dataset which is a true random sample from the population of interest. (Note: a true randomized experiment from a fixed set of individuals is much easier to implement, and indeed, randomized experiments are done in most medical studies these days.)

Dependent observations can bias results in ways that produce fundamentally flawed analyses. That is, if you hang out at the gym measuring height and weight, your linear model is surely not a representation of all students at your university. At best it is a model describing students who use the gym (but also who are willing to talk to you, that use the gym at the times you were there measuring, etc.).

In lieu of trying to answer whether or not your observations are a true random sample, you might instead focus on whether or not you believe your observations are representative of the populations. Humans are notoriously bad at implementing random procedures, so you should be wary of any process that used human intuition to balance the data with respect to, for example, the demographics of the individuals in the sample.

21.6.3 Normality

The normality condition requires that points vary symmetrically around the line, spreading out in a bell-shaped fashion. You should consider the “bell” of the normal distribution as sitting on top of the line (coming off the paper in a 3-D sense) so as to indicate that the points are dense close to the line and disperse gradually as they get farther from the line.

The normality condition is less important than linearity or independence for a few reasons. First, the linear model fit with least squares will still be an unbiased estimate of the true population model. However, the standard errors associated with variability of the line will not be well estimated. Fortunately the Central Limit Theorem tells us that most of the inferential analyses (e.g., standard errors, p-values, confidence intervals) done using the mathematical model will still hold (even if the data are not normally distributed around the line) as long as the sample size is large enough.

One analysis method that does require normality, regardless of sample size, is creating intervals which predict the response of individual outcomes at a given \(x\) value, using the linear model, a topic covered in later courses. On additional reason to worry slightly less about normality is that neither the randomization test nor the bootstrapping procedures require the data to be normal around the line.

21.6.4 Equal variability

As with normality, the equal variability condition (that points are spread out in similar ways around the line for all values of \(x\)) will not cause problems for the estimate of the linear model, for a randomization test, or for a bootstrap confidence interval. However, data that exhibit non-equal variance across the range of \(x\)-values will have the potential to seriously mis-estimate the variability of the slope which will have consequences for the inference results (i.e., hypothesis tests and confidence intervals).

When the equal variability condition is violated and a theory-based analysis (e.g., p-value from T-score) is needed, there are existing methods which can easily handle the unequal variance (e.g., weighted least squares analysis), but these are covered in a later course.

21.7 Chapter review

Terms

We introduced the following terms in the chapter. If you’re not sure what some of these terms mean, we recommend you go back in the text and review their definitions. We are purposefully presenting them in alphabetical order, instead of in order of appearance, so they will be a little more challenging to locate. However you should be able to easily spot them as bolded text.

| correlation | intercept | normality |

| equal variability | least-squares regression line | predicted response |

| independence | linearity | slope |